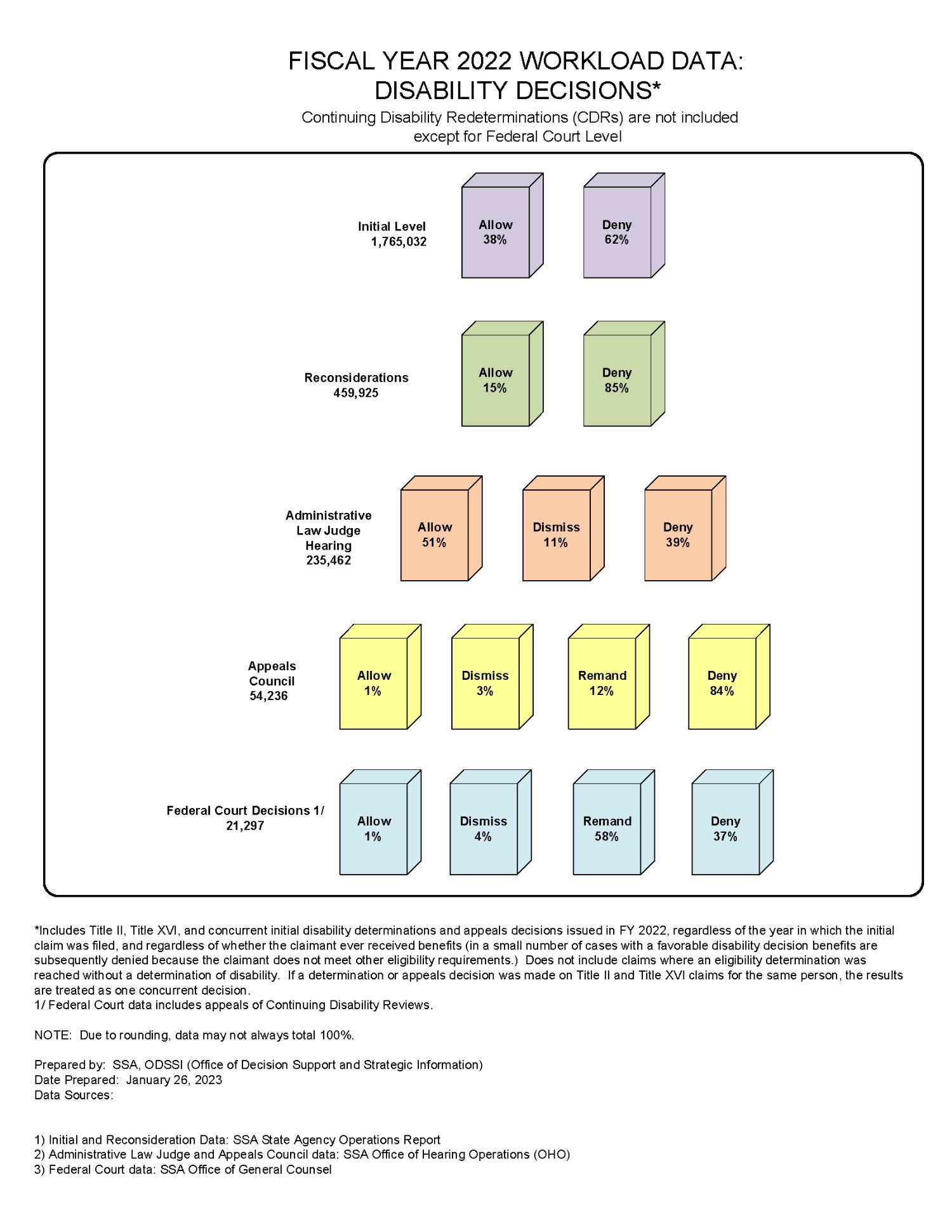

| | | | | | | | April 2023 Welcome to the new format of Disability Law News. We hope you enjoy this new design and find it easy to navigate. This April 2023 edition will cover the recent settlement in the Amin v. Kijakazi lawsuit regarding non-disability appeals; a new Emergency Message about probationary periods; a spotlight on Appeals Council deadlines; a POMS about an increase to the overpayment waiver tolerance; an updated Waterfall Chart for FY22; an updated Deeming Chart; a new online option for Continuing Disability Reviews; updated COVID practices; new court decisions, an updated Bulletin Board, and a tip about the benefit of breaks. | | | |  | Court Approves a Settlement in Amin | | The local field offices of the Social Security Administration (SSA) have been described as a black hole for claimants whose submissions seem to never be processed. Individuals who are entitled to continuing benefits are especially harmed by these failures, when reconsideration requests are not processed in time to preserve the right to continuing Supplemental Security Income (SSI) under Goldberg v. Kelly. A recent court settlement aims to improve SSA’s timely processing of SSI non-disability appeals and protect claimants from undue disruption in SSI benefits. On Monday April 3, 2023, the United States District Court for the Eastern District of New York approved a settlement agreement in Amin v. Kijakazi, 15-cv-07429 (EDNY) that provides for wide-reaching relief for SSA’s systemic failure to timely process non-disability appeals at the local office level. The case was brought by 14 individual plaintiffs in New York City but the relief provided under the settlement will apply nationally. The complaint alleged that SSA’s routine failure to accept and timely docket SSI appeals was a violation of the Due Process Clause of the Fifth Amendment, the Social Security Act, and federal regulation. Much of the relief under Amin has already been rolled out over the past 2 years, including changes to SSA’s computer systems and a significant change in policy. | | | Under Goldberg v. Kelly, an SSI recipient is entitled to continuing benefits if reconsideration is requested within 10 days; this 10-day deadline is codified in the regulations. See 20 CFR § 416.1336. Because SSA assumes a person received a notice five days after the date, this period is essentially 15 days from the date on the notice. Under the Amin settlement, SSA agreed to expand the Goldberg Kelly appeal period from 10 to 60 days. This was enacted in October 2021 via Emergency Message (EM) 21064 REV, which established a new 60-day timeframe for ensuring the continuation of SSI benefits during the pendency of an appeal of a suspension or reduction of benefits. The EM provides for an automatic finding of good cause for late filing where a reconsideration request is made between 10 and 60 days after receipt of the Notice of Planned Action to suspend or reduce their benefits. Good cause is still available after 65 but is not automatic. See EM-20050 REV. | | | | | | | |  | EM Issued on Vocational Evidence of Probationary Period Requirements | | In the January 2020 issue of this newsletter, we reported on several notable Second Circuit cases issued at the time, including Sczepanski v. Saul, 946 F.3d 152 (2d Cir. 2020). Sczepanski dealt with whether a claimant’s ability to complete a probationary or training period was relevant to a finding of disability. Three years later, SSA issued on March 27, 2023 Emergency Message (EM) 23021, aimed at preparing the agency to respond to claims that may be impacted by case. In the new EM, SSA instructs its staff on how to flag cases as potentially affected by the Sczepanski decision. The agency says that it is still considering whether an Acquiescence Ruling. In the meantime, it is flagging cases in New York, Connecticut and Vermont in which the claimant was found capable of doing other work in the national economy and where there is vocational evidence in the record about employer probationary periods for at least one of the occupations identified at Step 5. | | | In Sczepanski, the Circuit had found that in fact, the plaintiff’s impairment-related inability to complete a probationary period was relevant to the evaluation of whether she could perform work in the national economy. In that case, the record included cross-examination of the vocational expert (VE) by the claimant’s non-attorney representative, asking specifically about tolerated levels of absenteeism, especially in the probationary period. The plaintiff was likely to be absent one day a month, and the VE had testified that such absenteeism would not be tolerated during the training period. The ALJ, however, declined to consider limitations in the probationary period specifically. The court remanded the claim for further proceedings. | | | | | | | |  | Spotlight on Appeals Council Deadlines | | Sixty-day deadlines govern all levels of Social Security appeals, including requests for review of decisions by Administrative Law Judges (ALJs) at the Appeals Council. 20 C.F.R. §§ 404.968(a) & 416.1468(a). And decisions by the Appeals Council must be appealed to U.S. District Court within 60 days. 20 C.F.R. §§ 404.981 & 416.1481. If a claim has been remanded from U.S. District Court for further administrative proceedings, however, a resulting ALJ denial triggers different rules. The ALJ decision is considered a recommended decision to which exceptions may be filed with the Appeals Council within 30 days of the ALJ decision. Even if no exceptions are filed, the Appeals Council can assume jurisdiction on its own within 60 days of the ALJ decision. If it does so, it will notify the claimant and provide an opportunity to file written statements or arguments. Any decision issued by the Appeals Council, either after a claimant’s or its own review, can be appealed to court under the normal 60-day deadline. 20 C.F.R. §§ 404.1484 & 416.984. | | | But…if no exceptions are filed and the Appeals Council does not assume jurisdiction, the ALJ decision becomes the final decision of the Commissioner and thus appealable directly to U.S. District Court. 20 C.F.R. §§ 404.1484(d) & 416.984(d). A recent exchange on the DAP listserv highlighted this distinction. Advocates may approach these claims differently, with some usually opting to take advantage of the opportunity to file exceptions, and others choosing to by-pass the Appeals Council and file immediately in U.S. District Court. Advocates report varying results with these options. Michael Telfer of the Legal Aid Society of Northeastern New York (LASNNY), for example, recently obtained a remand order from the Appeals Council based on his exceptions to the ALJ’s decision where the ALJ failed to follow through on a promise to issue a subpoena to obtain additional medical evidence. Some advocates instead choose to skip what they perceive to be a futile trip back to the Appeals Council. | | | | | | | |  | Regulations _______________________________________________________________________________________________________ | | Failure to Cooperate POMS Revised | | Advocates have frequently complained to the Social Security Administration (SSA) about the vagaries of its policies regarding suspensions and terminations based on an individual’s alleged failure to cooperate. An article in the January 2022 edition of this newsletter outlines “N20 status,” which allows for nonpayment when a person fails to provide information needed to determine continuing Supplemental Security Income (SSI) eligibility and benefit amounts. An Emergency Message (EM) had placed a hold on these suspensions during COVID-19 without management level approval. SSA has now revised its POMS governing when and how these N20 suspensions can be effectuated. POMS SI 02301.235 provides detailed instructions and guidance for adjudicators, who are admonished not to “misuse or overuse the N20 suspension.” For example, N20 suspensions are not applicable when the recipient cannot be located, needs a capability assessment, or payee development. The POMS detail efforts adjudicators must take to locate and follow up with beneficiaries before applying N20 status. Of note, management approval is required to apply an N20 suspension. | | | Overpayment Waiver Tolerance Increased | | The Social Security Administration (SSA) has revised it Program Operating Systems Manual (POMS) to increase the “margin” it tolerates when determining whether collection of a Title II overpayment would “defeat the purpose of Title II of the Social Security Act” from $25 to $55 per month. See GN 02250.100 Defeats the Purpose for Title II - Waiver Determination. For a Title II waiver to be granted, overpaid individuals must demonstrate they were without fault in causing the overpayment and that recovery would defeat the purpose of the Act. See 20 C.F.R. §§ 404.506 et seq. (A waiver can also be granted if recovery would “be against equity and good conscience.” 20 C.F.R. §§ 404.509.) Collection would defeat the purpose if it would “deprive a person of income required for ordinary and necessary living expenses.” 20 C.F.R. §§ 404.508. | | | | | | | |  | Court Decisions _______________________________________________________________________________________________________ | | Second Circuit Remands for Failure to Develop | | In a recent Summary Order, the Court of Appeals for the Second Circuit remanded a claim based on the Administrative Law Judge’s (ALJ’s) failure to develop the record in a case with a pro se claimant. Rivers v. Kijakazi, 2023 WL 2485467 (Mar. 14, 2023). The court relied on its precedents requiring the ALJ to develop a claimant’s medical history where there are deficiencies in the record. See, e.g., Rosa v. Callahan, 168 F. 3d 72, 79 (2d Cir. 1999). Here, the ALJ was on notice that the claimant had three treating physicians who had treated her for her spinal injury and back pain, including one whom she had seen shortly before her hearing. The ALJ failed to contact any of these physicians for their medical opinions. This was legal error, especially in light of an earlier report in the record from one of the physicians imposing limitations. The claimant had testified that the same physician had indicated her condition had worsened and had encouraged her to apply for disability. The ALJ’s error was compounded by the fact that this claim was filed prior to March 27, 2017, and was governed by SSA’s prior “treating physician regulations,” which accorded controlling weight to well-supported opinions of treating physicians. | | | The court also concluded the evidence upon which the ALJ had relied was not substantial. Instead, the ALJ’s rejection of the claim appeared largely based on an internally inconsistent report from a consultative examiner hired by the Social Security Administration (SSA). The ALJ further erred by relying too heavily on what he viewed as the claimant’s ability to perform her daily activities adequately, including caring for her children. The court found nothing inconsistent with her claim of back pain and taking care of her children, especially since she testified as to help she needed from her family. The court also criticized the ALJ’s rejection of the claim based on his perception that the claimant was not receiving the type of treatment generally received for someone with her condition, given that he had no competent medical opinion before him about typical treatment. Congratulations to Attorney Mark Schneider of Plattsburgh for this victory. | | | | | | Send Us Your Decisions!

Have you had a recent ALJ or court decision or SSA update that you would like to see reported in an upcoming issue of the Disability Law News?

We would love to hear from you!

Contact Jennifer Karr, jkarr@empirejustice.org or Emilia Sicilia, esicilia@empirejustice.org | | | |  | Notaries, Take Note - It's the Law Now | | Significant changes to New York’s notary law went into effect in January 2023. The amendments to the New York Executive Law allow for electronic notarization, change the requirements for record-keeping and identity verification, and repeal the remote ink notarization provision enacted during the pandemic. All New York State notaries must now keep a journal of in-person and electronic acts and services. The contemporaneous record must be kept for ten (10) years and include the date, time and type of act, the name and address of the individual who requires the services, how many services were provided, and how the identity of the individual was verified. There are additional requirements for electronic notarial acts: record of the technology used, the certification authority and the verification providers used. | | | The new regulations update how a notary verifies the identity of an individual. A notary may accept a current government identification card with a photo, a physical description and a signature or two current documents issued by a business entity, institution, federal or state government, with the individual’s signature. The notary may also verify identity with an oath or affirmation of a witness who is personally known to both the individual and the notary, an attestation by the notary if the individual is personally known to them, or the oath or affirmation of two witnesses who know the individual personally and provide valid government identification. | | | | | | | |  | SSA Updates COVID-19 Related Practices | | Social Security continues to update policies enacted during the COVID-19 Public Health Emergency. Since the last issue of Disability Law News, the policy requiring masks in SSA’s offices changed, as did the policy for telephone consultative examinations. SSA’s COVID-19 Workplace Safety Plan 3, released on March 27, 2023, outlines relaxed masking requirements in all agency buildings. Masks will no longer be required unless the COVID-19 Community Level for the county in which the office is located is “high.” The Centers for Disease Control and Prevention (CDC) website maintains a COVID-19 County Check database to “know before you go.” Masks will be provided to visitors, if needed, when county community levels are high. | | | SSA released a new Emergency Message (EM 23027) revising their policy for conducting telehealth consultative examinations (CEs). Disability Determination Services (DDS) must follow the new guidelines as of May 12, 2023, the day after the expiration of the COVID-19 Public Health Emergency. Prior to the pandemic, telehealth CEs were required to take place in agency-provided locations with agency equipment, using secure broadband connections. During the pandemic, claimants and beneficiaries were allowed to attend a CE virtually from a location of their choice. DDS employees will be required to obtain verbal or written consent to schedule a telehealth CE. They must confirm the claimant will use a device with a camera and microphone and will be in a private environment with a reliable internet connection. There are additional requirements for speech and language CEs. The CE providers are ultimately responsible for complying with the Health Insurance Portability and Accountability Act (HIPAA). | | | | | |  | SSA Announces Online CDR Reporting | | The Social Security Administration (SSA) is required to periodically review the current medical condition of all people receiving disability benefits to determine if they continue to have a qualifying disability. 42 U.S.C. §§ 421(h), 423(f); 20 C.F.R. §§ 404. 404.1594 & 416.994a. And see Spotlight on CDRs in the April 2021 edition of this newsletter. At the commencement of the CDR process, beneficiaries are contacted by SSA for updated disability reports, which has typically been done by mail. Eligible beneficiaries now have the option to either return the report by mail or complete the forms on-line using their personal my Social Security account. | | | If eligible, the person can log in to their account and complete the Continuing Disability Review Report (Form SSA-455) and Authorization to Disclose to Information to the Social Security Administration (Form SSA-827). Once submitted, they will receive an email confirmation. Of note, this process is only available after the beneficiary has received a request for an updated disability report in the mail. Nor is it available to beneficiaries who have representative payees. | | | | | | | |  | | | SSA FY2022 Waterfall Chart | |  | | | Bulletin Board _______________________________________________________________________________________________________ | | This "Bulletin Board" contains information about recent disability decisions from the United States Supreme Court and the United States Court of Appeals for the Second Circuit. These summaries, as well as earlier decisions, are also available here. Synopses of non-precedential summary orders issued by the Second Circuit are available at our Second Circuit Update page of our website www.empirejustice.org. We will continue to write more detailed articles about significant decisions as they are issued by these and other Courts, but we hope that these lists will help advocates gain an overview of the body of recent judicial decisions that are important in our judicial circuit. | | | | U.S. v. Vaello Madero, 142 S. Ct. 1539 (April 22, 2022) In an 8-1 decision, the Supreme Court held that the exclusion of residents of Puerto Rico from the Supplemental Security Income (SSI) program does not violate the United States Constitution. The Court applied the rational basis test to find it permissible to treat residents of territories such as Puerto Rico differently than if they lived in a state because of the different tax status applicable to territories, an outcome authorized by the Territories Clause of the Constitution. The Court declined to rebuke the Insular Cases, a line of case law that sanctioned the colonial relationship of the U.S. to the territories, and that determined the full scope of the Constitution did not apply. A lone dissent by Justice Sonia Sotomayor described the majority decision as “especially cruel given those citizens’ dire need for aid.” Carr v. Saul, 141 S.Ct. 1352 (Apr. 22, 2021) The Supreme Court held that a claimant is not precluded from raising a legal issue for the first time in U.S. District Court if it was not raised before the Administrative Law Judge (ALJ). The underlying issue in question in Carr and its companion cases was whether the ALJ was properly appointed under the Appointments Clause of the U.S. Constitution. In the aftermath of Lucia v. Securities and Exchange Commission, 138 S.Ct. 2044 (2018) challenging the constitutionality of SEC ALJs, Carr and other plaintiffs challenged the legitimacy of the ALJs who had denied their disability claims and sought new hearings. The Commissioner argued the plaintiffs had forfeited their Appointments Clause challenges because they had not raised them before SSA during the administrative appeals process. The Supreme Court resolved a conflict in the circuits by holding that given the non-adversarial nature of SSA hearings, issue-exhaustion is not required. Smith v. Berryhill, 139 S.Ct. 1765 (2019) The Supreme Court held that an Appeals Council dismissal of a request for review is a final decision subject to judicial review. The Court unanimously held that where the Appeals Council has dismissed a request for review as untimely after a claimant has obtained a hearing from an ALJ on the merits, the dismissal qualifies as a “final decision . . . made after a hearing” within the meaning of 42 U.S.C § 405(g). It distinguished its earlier ruling in Califano v. Sanders, 430 U.S. 99, 97 S.Ct. 980, 51 L.Ed.2d 192 (1977), by emphasizing that as opposed to the denial of a request for reopening in Sanders, there had been a decision by an ALJ on the merits of the plaintiff’s claim. Biestek v. Berryhill, 139 S.Ct. 1148 (2019) In a 6-3 decision, the Court declined to adopt a categorical rule that a vocational expert’s supporting data must be provided in order for the testimony to constitute substantial evidence. But the majority acknowledged that in some cases it may be possible to draw an adverse inference against a VE who refuses to provide supporting data. | | | | Rucker v. Kijakazi, 48 F.4th 86 (2d Cir. Sept. 6, 2022) The court remanded, finding the Administrative Law Judge (ALJ) failed to assess the plaintiff’s mental Residual Functional Capacity (RFC) properly under the under the pre 2017 opinion evidence regulations that applied in this case, particularly regarding her ability to work consistently, as well as her limitations regarding social interactions. Various treating sources had opined that the plaintiff, who has several mental impairments including low intellectual functioning, was extremely limited in terms of work-related activities. The court cited Social Security Ruling (SSR) 85-15, which emphasizes the extent to which reactions to demands of work stress are highly individualized, in finding the jobs relied upon by the ALJ to demonstrate the plaintiff could perform “simple work alone with normal supervision” were inadequate simply because they involved the lowest levels of human interaction. The plaintiff’s subjective reports were insufficient to reject the treating psychiatrist’s opinion given the plaintiff’s poor insight. Nor should the ALJ have relied on the plaintiff’s attendance at medical appointments in determining that she could consistently show up and function in a work environment. Schillo v. Kijakazi, 31 F.4th 64 (2d Cir. Apr. 6, 2022) The court affirmed the District Court decision under the pre 2017 opinion evidence regulations that applied in this case. It found the ALJ properly accorded lesser weight to the opinions of two treating physicians because one was conclusory and vague and the other, rendered in check-box format, was not supported by the medical evidence. And according to the court, both opinions as to the plaintiff’s tremors and sensory deficits were inconsistent with the medical evidence, which identified only mild tremors, and the plaintiff’s testimony. The court also agreed with the ALJ’s assessment that the opinion of the consultative examiner was entitled to even less weight. It rejected plaintiff’s argument that the ALJ could not make an RFC finding because she had declined to accord controlling weight to any of the medical opinions; the ALJ is entitled to weigh all available evidence to make RFC findings and her conclusion need not perfectly correspond with opinions of record. Finally, the court found that the ALJ’s failure to articulate the so-called Burgess factors for evaluating treating source opinions to be harmless error as it was evident, she had applied the substance of the treating physician rule. Colgan v. Kijakazi, 22 F.4th 353 (2d Cir. Jan. 3, 2022) The court remanded, finding the ALJ erred in failing to accord controlling weight to the opinion of the treating physician under the pre 2017 opinion evidence regulations that applied in this case. The court held the ALJ failed to find good reasons under the old regulations for discounting the opinion of a concussion specialist that the plaintiff would be off task 33% of the day and absent more than four days per month due to her headaches and other impairments. The ALJ also erred in discounting the opinion because it was presented in “check box” form; the opinion was supported by voluminous treatment notes. The court criticized the ALJ for “cherry-picking” particular instances of improvement to create inconsistencies with the treating source opinion. And it criticized the ALJ for relying too heavily on the opinions of consulting physicians, particularly where the consulting opinions did not address or dispute the crux of the treating source’s opinion. Alexander v. Saul, 5 F.4th 139 (2d Cir. July 8, 2021) The Second Circuit upheld a district court’s refusal to extend the time to appeal its decision affirming the Commissioner’s denial of an SSI claim. Although the Circuit was “sympathetic” to the plaintiff, it concluded the district court had not abused its discretion – even though the plaintiff filed her appeal and request for an extension only two days after the 60-day deadline expired. The district court had reasonably applied the “excusable neglect” factors rather “good cause” standard under Fed. R. App. P. 4(a)(5) because the plaintiff’s failure to appeal was at least partially due to her own inadvertence in failing to notify her attorney of her change of address rather than due to her alleged mental illness. The court refused to toll the Rule 4(a) (5) deadline as it is considered jurisdictional and less flexible than the statute of limitations governing the 60-day limit to seek judicial review under 42 U.S.C. § 405(g). Sczepanski v. Saul, 946 F.3d 152 (2d Cir. 2020) The court held that the ability to complete work during the probationary period is relevant to a disability claim. It remanded for further proceedings at Step five of the Sequential Evaluation to determine whether the claimant could perform work as required during the probationary period, including meeting the levels for absenteeism tolerated by the employer. Estrella v. Berryhill, 925 F.3d 90 (2d Cir. 2019) The Court of Appeals endorsed in strong terms the value of treating source evidence and affirmed its prior treating physician rule cases. The court faulted the ALJ for failing to consider explicitly the Burgess factors incorporated into the former opinion evidence regulations, which were replaced in 2017 by 20 C.F.R. §§ 404.1520c(a) & 416.920c (a). The new regulations were not considered by the court. Lockwood v. Comm’r of SSA, 914 F.3d 87 (2d Cir. 2019) The Court of Appeals remanded because the ALJ had not met his affirmative obligation under SSR 00-4p to inquire about any possible or apparent conflicts between vocational testimony and the Dictionary of Occupational Titles (DOT). The court found the ALJ did not meet his burden simply by asking the vocational expert if her testimony was consistent, especially where the ALJ found the plaintiff could not reach overhead, but the three jobs to which the VE testified all required frequent or occasional reaching. | | | |  | | | | | | | End Note ________________________________________________________________________________________________________ | | | | Feeling guilty that you are goofing off and staring out the window instead of finishing that pre-hearing memo due tomorrow? Maybe your brain needs a break. And if so, it may well be better to daydream than to trawl the internet or play Angry Birds. According to Gloria Mark, professor of informatics at the University of California, Irvine, “[w]e can’t expect to lift weights nonstop all day, and we can’t expect to use sustained focus and attention for extended periods of time, either.” And taking that break may improve your ability to do quality work. An article published in the journal PLoS ONE in 2022 found that even short breaks of ten minutes or less reduced mental fatigue and improved performance on tasks requiring creativity. The longer the break, the better the performance boost. Marta Sabariego, an assistant professor at Mount Holyoke College who studies attention and other behaviors, says switching from the task-related network of our brain to the default network can help with problem solving and innovation. Giving our thoughts the room to roam, like in the shower, can lead to creative thinking. | | | How often do you need to give your brain a break? In this age of multitasking, research shows workers shift from screens or tabs every 44 seconds. These jumps can increase mistakes, reduce creativity, and cause fatigue. As a result, you’ll probably need more frequent breaks. According to Dr. Sabariego, there is no hard and fast rule. She recommends, however, trying to build focus by staying on task for increasing periods. And remember it takes time to get back to work after an interruption. One of the best ways to take a break may be physical activity in nature, or even a walk through your building. Just don’t scroll through your phone during your walk! For more on productive breaks, see “How to Tell If Your Mind Needs a Break,” The New York Times, Feb. 3, 2022. | | | | | | Contact Us! Advocates can contact the DAP Support attorneys at:

Emilia Sicilia: (914) 639-4232, esicilia@empirejustice.org

Jennifer Karr: (585) 295-5824, jkarr@empirejustice.org

Ann Biddle: (646) 602-5671, abiddle@urbanjustice.org | | | | | | | | Disability Law News©

is published four times per year by:

Empire Justice Center

1 West Main Street, Suite 200

Rochester, NY 14614

Phone: (585) 454-4060

The newsletter is written and edited by:

Jennifer Karr, Esq.

Emilia Sicilia, Esq.

Ann Biddle, Esq.

April 2023 issue.

Copyright© 2023,

Empire Justice Center

All rights reserved.

Articles may be reprinted

only with permission

of the authors.

Available online at:

www.empirejustice.org | | | | | | | | | |